The United States construction market is a $2.4 trillion dollar industry, with over 4 million participants as of September 2021.

Since the aftermath of the 2008-2009 financial recession, the growth in new construction companies has ballooned; approximately 81,000 new construction companies per year have entered the market, on average, since 2014.

While the owners of construction companies receive initial advice upon formation and continuing advice as the company grows, how many contractors are adequately guided on their options upon exiting the industry?

The Importance of Exit Planning Strategies

Every company must have an exit strategy for its primary stakeholders that gives the exiting owners future financial freedom, and its remaining owners, employees and customers the best possible chance of long-term success.

The timing and details of exiting owners cannot always be known but documenting a strategy and plan can ensure maximized value to selling shareholders and a smooth transition for current employees.

Exit Planning Institute (EPI) research studies indicate that 75% of owners experience “profound regret” within 1 year of exiting their business, which suggests that the majority of exit planning strategies have failed or were never present. EPI indicates that 83% of owners fail to procure a written exit strategy.

Given that management succession can be a time-sensitive and deeply emotional process, it is no surprise that owners lack the necessary tools and guidance to favorably transfer the business to the next generation of owners. But this trend does not have to continue for both the prior and next wave of owners.

FMI Corporation, a leading provider of consulting and investment banking services, states that the cycle of ownership transitions every 25 to 30 years, and this transition “is currently being fueled by the high level of baby-boomer retirements.”

EPI estimates that 66% of the current American business market is owned by baby boomers, who are set to transition or retire over the next 10 years. Additionally, according to a 2017 survey by FMI, 50% of all construction firms will change ownership in the next 10 years.

Given this wave of future expected transitions, owners need to have a well-defined plan, even if a sale is not immediately pending. Personal and family concerns, recessions, unexpected offers and unexpected death should be the trigger for an exit plan.

Key Considerations in Forming Exit Strategies

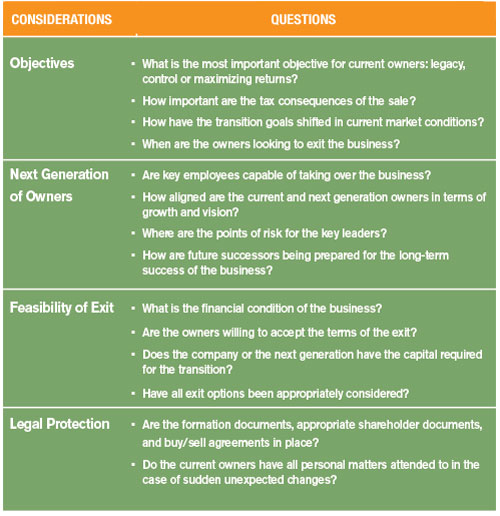

Contractors must be educated and guided through the transfer process, which can take as long as 3 to 5 years to complete. Some key questions to determine the owner’s priorities and the goals of the business are detailed in Figure 1.

These questions provide a solid guide for discussion among key stakeholders to align the existing owners’ goals with the long-term goals of the business. Once key objectives are set, owners must begin to plan, carefully considering all the sale options available.

Exit Options Available to Contractors

Sale options include selling to external or internal buyers. Some examples of common exits with external buyers include:

- Sale to a strategic buyer

- Sale to a private equity group

- Merger

- Initial public offering

Some examples of common exits with internal buyers include:

- Selling or gifting ownership interests to family members

- Sale to other current owners

- Sale to nonowners – management (or another key employee) buyout

- Employee stock ownership plan (ESOP)

When it comes to the most common sale options, according to a 2017 survey from FMI, a majority of construction owners plan to initiate internal transactions, with 52% of respondents indicating that they plan to sell to employees via a direct sale or through an employee stock ownership plan.

Employee Stock Ownership Plan as a Buyer for Contractors

An ESOP is an attractive option for owners of construction companies. According to the most recent data (2020) from the National Center of Employee Ownership (NCEO), the construction industry was the most active for new ESOPs, with construction companies undertaking more ESOPs than any other industry.

As with every major life decision, an examination of options is crucial. As the majority of construction companies are closely held businesses, the three most widely discussed exit options among mid-size construction company owners are sale to a third party, sale to management or family members and sale to an ESOP.

Consideration of the advantages and disadvantages of sale to third party, sale to management members, and sale to an ESOP are outlined below.

1. Sale to a Third Party: Exit Option

ADVANTAGES

Once a deal is consummated with a third party, the risk of payment as well as the timing of receipt of payment is much lower than in a sale to an internal party. While some third-party transactions have clauses to prevent downside risk, such as clawbacks, escrow and other contingent considerations (usually based on performance), selling shareholders

are likely to be paid in a much

shorter timeframe.

The sale price to a specific third party, also known as investment value, can constitute a higher value (prior to taxes) than fair market value, otherwise known as strategic value.

Selling to private equity could result in greater access to capital.

Ability to leverage industry experts (i.e., competitor, private equity, etc.).

DISADVANTAGES

Ninety-five percent of construction companies are not strong candidates for sale to a third party. Size, profitability, visibility of profits beyond current backlog, highly leveraged balance sheets and company culture are all distinguishing factors that influence the salability of a contracting business.

Historically, less than 25% of contractors are successful in selling their companies to a third-party buyer. This is due to a multitude of reasons, including:

Differences in personality and management style between sellers and buyers can create strategic divides.

The valuation gap stemming from unrealistic valuation expectations from sellers or low-ball offers from buyers can result in disappointing offers to selling shareholders, foiling potential deals.

The construction industry is highly cyclical, and buyers may be risk-averse if a particular contractor is experiencing a temporary slowdown.

If any single large contract of the seller is unprofitable, buyers may over-penalize by reducing their offer (e.g., emphasizing the risks in achieving profits with each job).

The construction industry, generally speaking, is highly leveraged. This leverage makes consummating a deal more difficult.

FMI states that between 70% and 90% of acquisitions fail to create value for the acquirer and its shareholders. Value detractors not adequately considered in the due diligence phase of the sale that contribute to this statistic are as follows: inflated earnings, no synergies with the buyer, a high number of insurance claims, high customer concentration, differing management styles, aging fixed assets, poor employee morale, clashing company cultures and job-specific construction complexities.

The sale process can take a considerable amount of time from beginning to close — between 9 and 19 months.

Depending on the size and complexity of the sale, investment banking fees can range between 1 and 8% of the company’s enterprise value.

Sale to a Third Party: Asset vs. Stock Deals

Merger and acquisition (M&A) deals are generally structured in one of two ways: as asset deals or stock deals.

Research shows that most construction deals are asset deals, revealing that buyers of most construction companies are not purchasing cash flows and the equity of a company, but rather, the fixed assets and employees. This also allows buyers to “select” which assets they are buying, while avoiding the assumption of company liabilities (including unknown liabilities).

Selling owners understand that, in many cases, asset deals result in the liquidation of the selling business. Additionally, asset deals exhibit lower implied revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples than stock deals. For all U.S.-based construction closed deals since Jan. 1, 2010, through Sept. 30, 2021, DealStats and CapitalIQ databases show asset transaction EBITDA multiples of 31.6% and 30.7% lower, respectively, than stock deals in the same time period for the transactions presented.

Additionally, in 2020, construction M&A completed deals slowed significantly as a result of the COVID-19 pandemic. As reported by DealStats and CapitalIQ, the number of deals completed for construction companies declined 33% and 31%, respectively, from 2019 to 2020. In the year to date ended Sept. 30, 2021, deal count has increased, but not to the sale levels as in 2019.

2. Sale to Management or Family Members

ADVANTAGES

Selling to existing members of management members or family provides a potential immediate “buyer” who likely already knows the business well. This can result in lower transactional fees than would otherwise be incurred to find and market a company to a qualified buyer.

Internal buyouts can be an effective strategy to retain the next generation of owners.

DISADVANTAGES

Many deals are offered at below fair market value, as the buyers are not getting an arm’s length deal.

A leveraged management buy-out (LMBO), where debt financing is

used to fund the purchase price, increases the risk of the timing and receipt of payment.

In a LMBO, the terms of the deal must incentivize the insiders to grow company cash flow as a means to fund the transfer, which at times comes at the detriment of long-term planning. Only future cash flows will provide the funds necessary to fund the transaction. This is because key employees typically don’t have the money to do so, and they cannot borrow funds to cash out the owner.

Family-run firms are particularly vulnerable to ownership transfer and succession management challenges — 88% of current family business owners believe the same family or families will control their business in 5 years; yet actual succession statistics undermine this belief. Data show that just 30% of family businesses survive into the second generation, 12% are still

viable in the third generation and only about 3% of all family businesses operate into the fourth generation

or beyond.

Bonding and banking both present significant hurdles for any firm looking to transition to a new generation of ownership. Bonding companies and banks are hesitant to provide credit unless the company has meaningful equity. If equity decreases because

of the transaction, all else being equal, bonding and banking credit levels

also decrease.

Internal sales can present future litigation by the selling owners if the terms of buy/sell, shareholder, or bylaw agreements are not properly followed.

Next generation management or family members may not be the best candidates to lead a company into the next several decades.

Internal transfers can take up to 8 to 12 years to fully cycle out of a 100% owned, closely held firm.

3. Sale to an ESOP

ADVANTAGES

Unparalleled tax advantages, including potential avoidance of capital gains tax and elimination/minimization of post-transaction corporate income tax and capital gains tax.

Financial wherewithal for management and employees to participate.

Indicator to surety that employees and clients will stay on and complete long-term projects.

Potential protection and perpetuation of the family name.

Preservation of company culture.

Incentive to retain and/or attract employees.

Executive compensation options available to reward key executives.

Transaction can close in a reasonable amount of time (3 to 6 months).

Flexibility of the sale structure. Owners can sell a portion or all their interests, the sale can happen with various financing vehicles (senior bank debt, subordinated seller notes, or cash) and the selling owners can determine their expected post-transaction tenure.

DISADVANTAGES

Highly leveraged transaction, in which debt is mitigated by significant tax savings. Debt is typically required to facilitate the transaction.

Sellers are at risk (if financed with seller notes) for a longer period and are partially dependent on the success of the next generation leaders. Seller notes are subordinate to senior third-party bank loans.

Longer period for selling owners to be fully paid on the seller notes (typically 5 to 10 years).

Takeaway Considerations

Owners must carefully consider all exit options in conjunction with the goals and objectives of the individual sellers, the company and future management to ensure success. Owners must have plenty of time to plan, consult their advisors, negotiate with the next generation of owners and, finally, execute the plan. These steps can help avoid regret, future shareholder litigation and the loss of value to the selling owners as well as the company. Many owners of construction companies are in a unique position in a post-COVID-19 world. ESOPs should be strongly considered by contractors as an option that provides liquidity and value, and preserves the heritage, culture and legacy of the company that owners spent years building.